Introduction - Section 154

You can submit a rectification request under section 154 for errors in the processing of your income tax return by CPC. Only mistakes apparent from record is considered for rectification, such as:

1. Total Tax Liability: For example, tax payments not matched as per the CPC order, cancellation of adjustment of earlier demand, variance in interest/tax computation, amending assessment order or intimation

2. Gross Total Income: For example, income chargeable under any head wrongly considered, salary income not matched, brought-forward losses not been allowed, incorrect set-off of current year losses, amending assessment orders, re-computing total income for succeeding year(s) in respect of loss or depreciation, withdrawing investment allowance, re-computing deemed capital gains.

3. Total Deductions: For example, details of deductions under Chapter VI-A wrongly considered, MAT/MATC or AMT/AMTC not allowed/partially allowed, amending assessment order to allow deduction for late remittance of foreign exchange.

4. Personal Information: For example, requesting to tax at slab rates for partners information of e-filed return, gender of taxpayer wrongly considered/gender updated in PAN database, reduction of tax rate as domestic instead of non-domestic company, date of filing of original return is taken as not within the due date, reduced claim of taxpayer income governed by Portuguese Civil Code, requesting change of residential status, or that the income shown in the return is not taxable as the assessee is a society registered under section 12A or is a non-resident.

Guide on Tax Collected at Source (TCS)

Step by Step Procedure to File Rectification Request

Now let us understand what are the different request types for income tax rectification under section 154?

1. Reprocess the Return

2. Tax Credit Mismatch Correction

3. Additional Information for 234C Interest

4. Status Correction (applicable to ITR-5 and ITR-7, applicable till Assessment Year 2018-19)

5. Exemption Section Correction (applicable to ITR-7 only, applicable till Assessment Year 2018-19)

6. Return Data Correction (Offline)

7. Return Data Correction (Online)

Now let us understand step by step process to file rectification request under section 154 :-

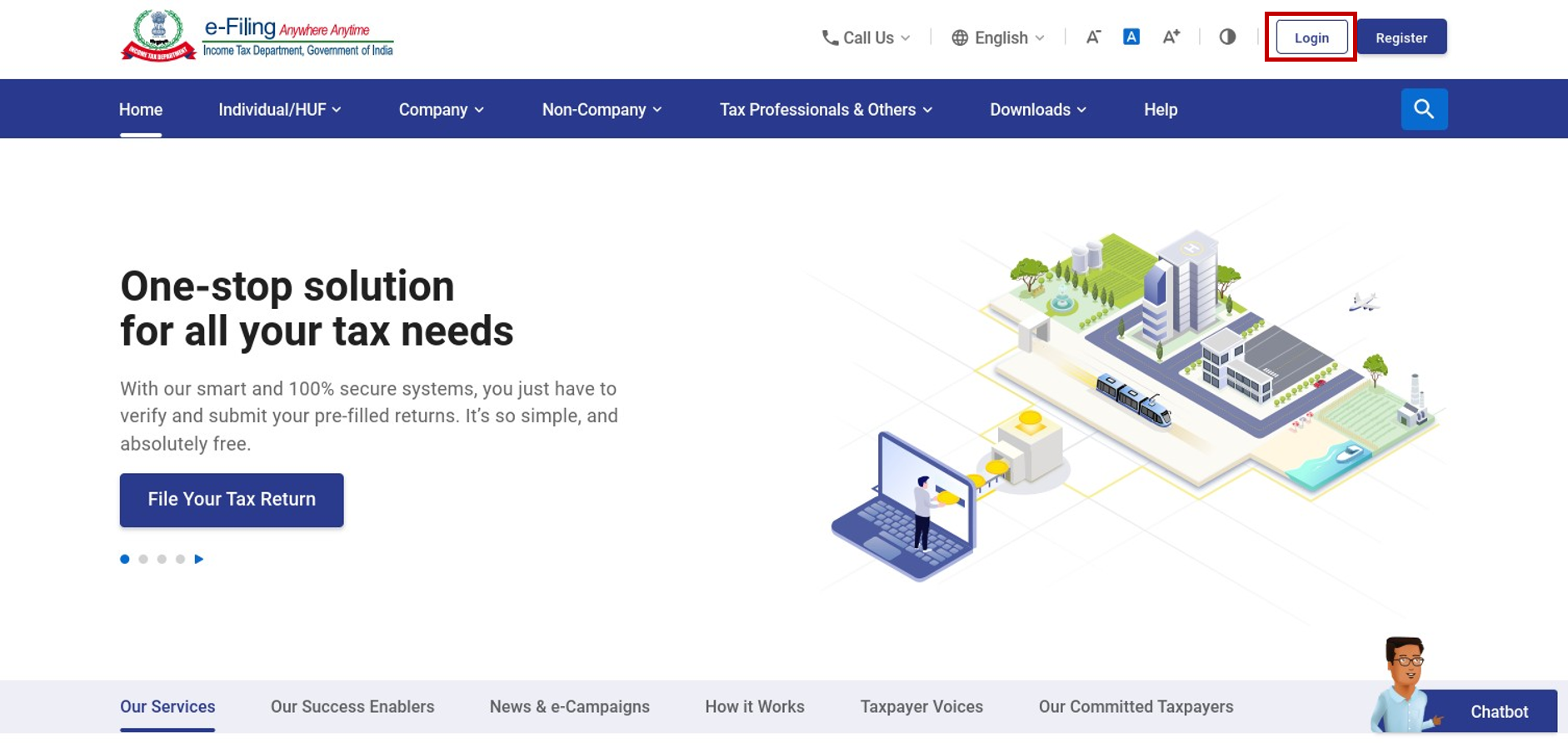

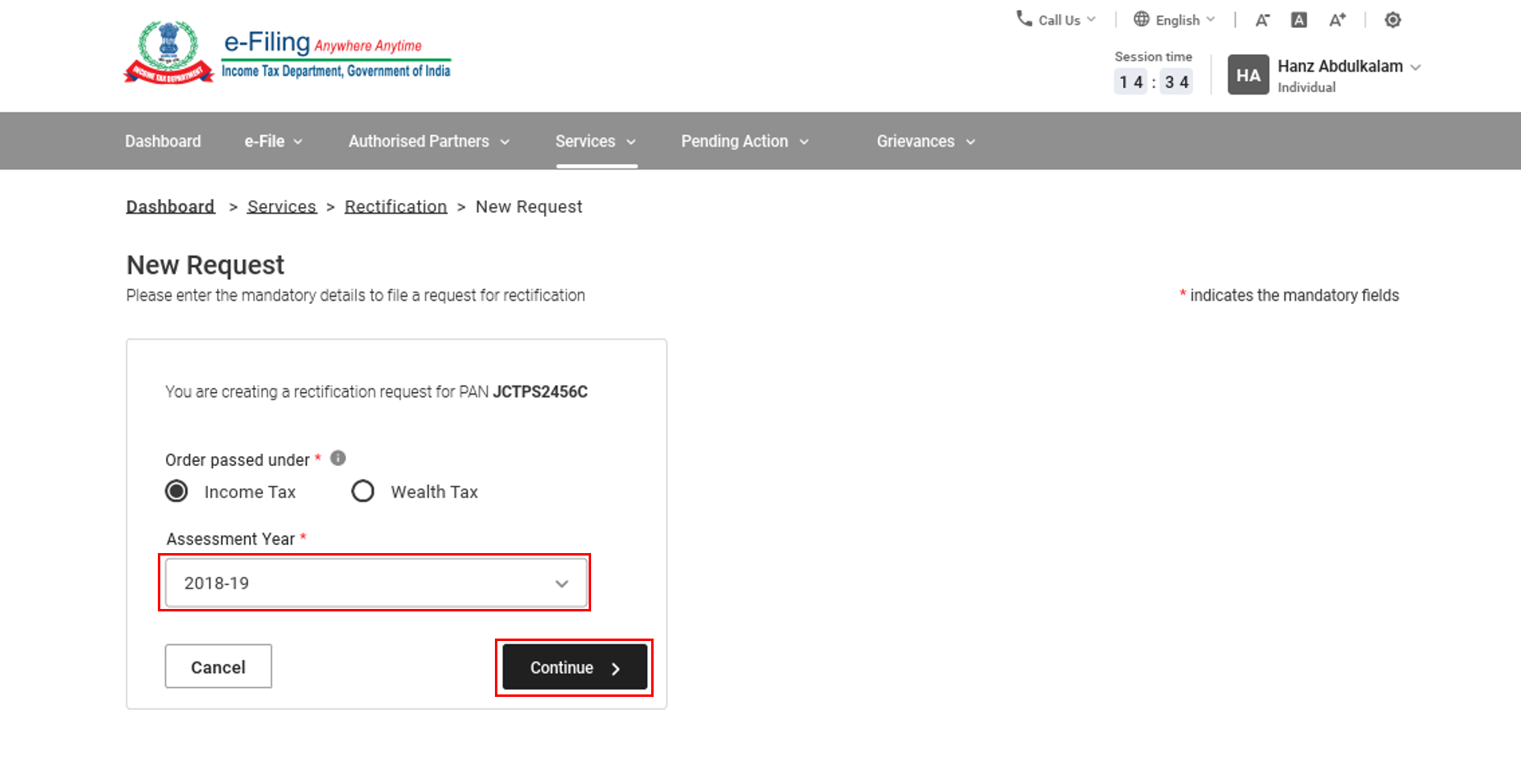

Step 1: Log in to the e-Filing portal using your valid user ID and password.

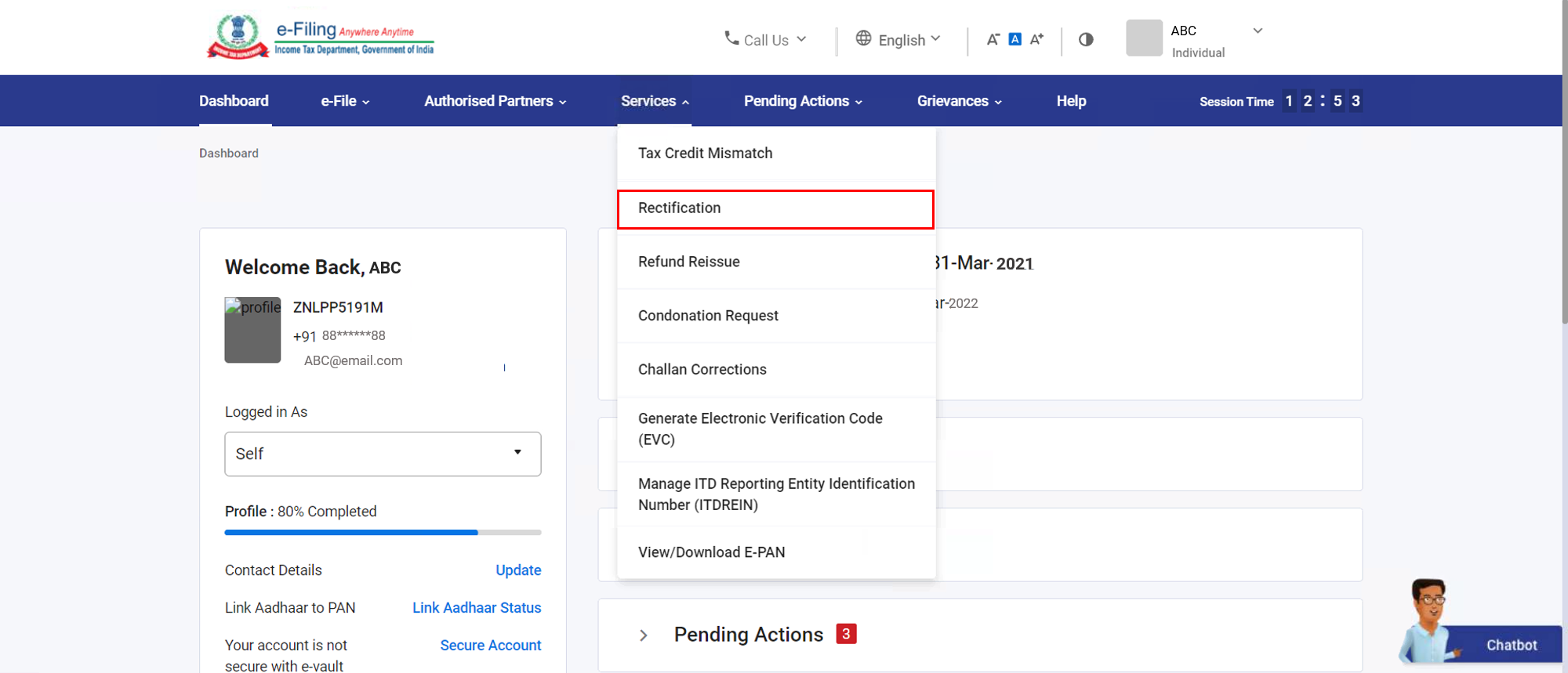

Step 2: Click Services – Rectification.

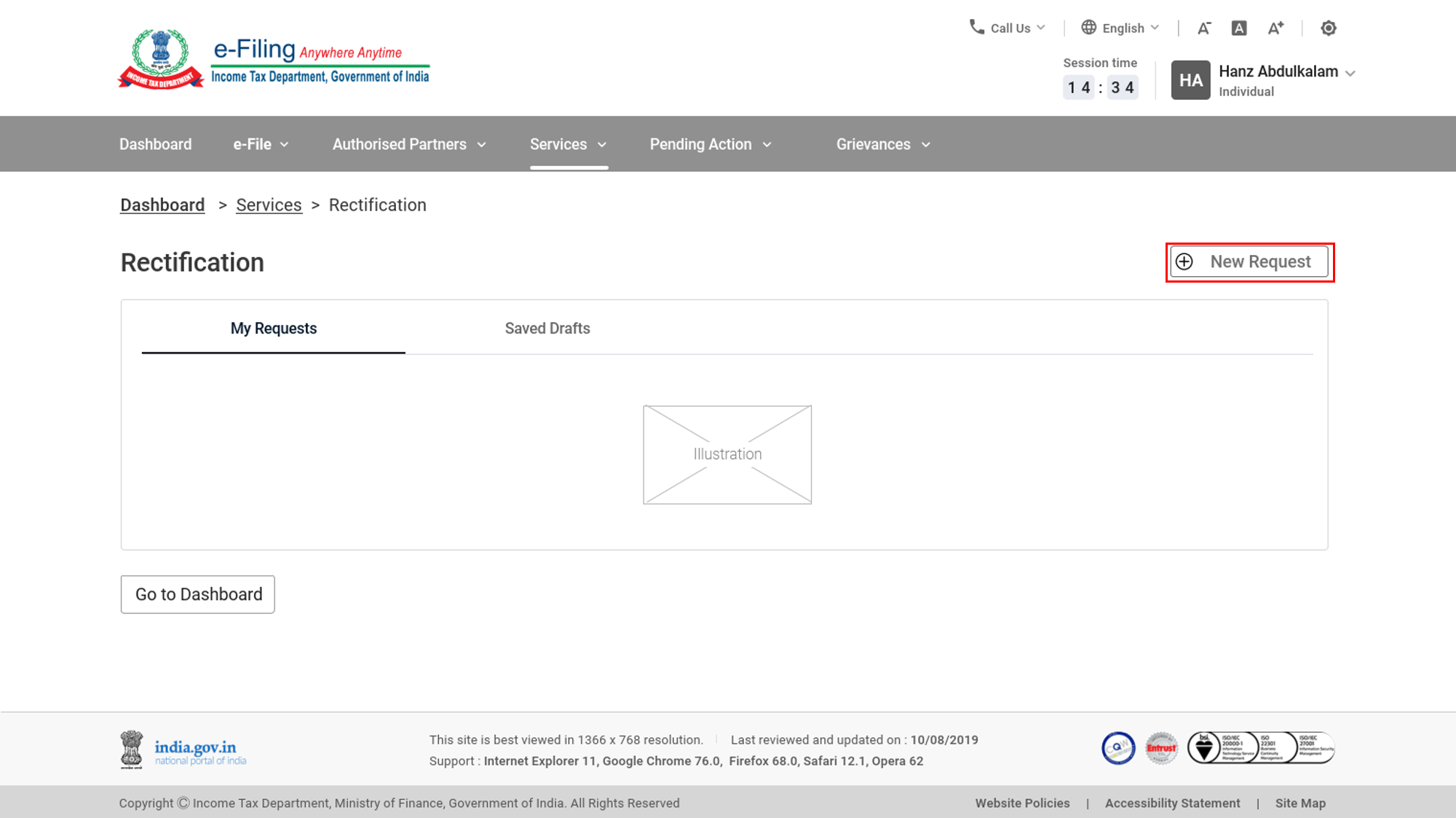

Step 3: On the Rectification page, click New Request.

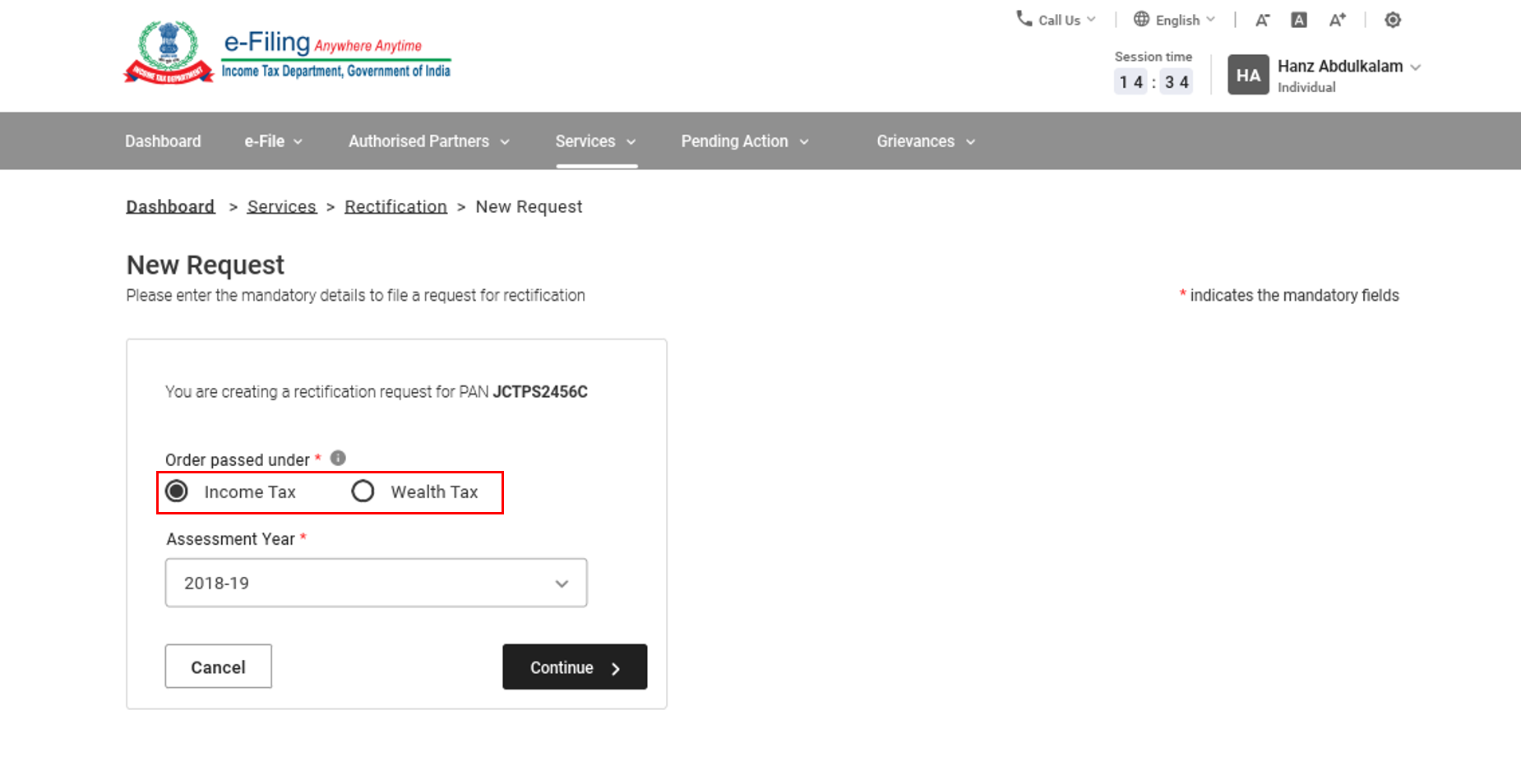

Step 4: On the New Request page, your Permanent account number will be auto-filled. Select Income Tax.

Step 5: Select the Assessment Year from the dropdown. Click Continue.

Step 6: Choose Rectification requests classification for example reprocess the return, tax credit mismatch correction, return data correction online or offline etc as per your requirement.

It is advisable to select ‘Reprocess the Return’ if you have furnished true and correct particulars in return of income and cpc has not considered the same during processing.

It is advisable to select ‘Tax Credit Mismatch’ if you want to correct details in tds/tcs/it challans of the processed return. Please reenter all the details in the schedules. All the corrected entries as well as other entries mentioned in the ITR filed earlier are to be entered. Make the necessary corrections in the data. While doing corrections, make sure not to claim credits which is neither a part of the processed return nor the 26AS statement.

It is advisable to select ‘Additional Information for 234C interest’ if you want correction in particulars of 234C interest calculation for correct processing by cpc.

It is advisable to use ‘Status Correction’ if you have been charged maximum marginal tax rates during processing by department without giving effect to correct status and sub status.

‘Exemption Section Correction request’ may be made if you are an institution/entity claiming exemption under section 10 and required correction in particulars of exemption.

In ‘Return data correction (Offline)’ selection of appropriate reasons while submission of rectification request in mandatory for correct processing of request by the department. Please re-enter all the entries in the schedules. All the corrcted entries as well as remaining entries mentioned in the ITR filed earlier are to be entered. Make the necessary corrections in the data. While doing corrections, make sure not to declare any new source of income or declare additional deductions.

In ‘Return data correction (Online)’ also you have to select appropriate reasons for data correction in return for correct processing by CPC in support of claim for rectification.

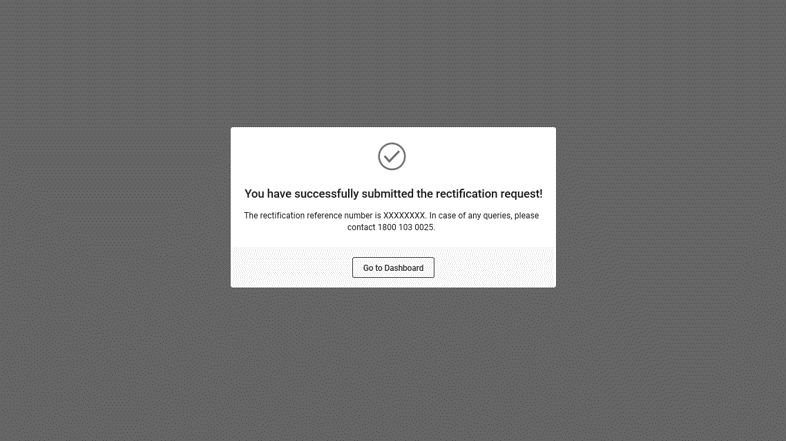

Step 7 : After selecting appropriate class for rectification and filling all details please submit the request. On submission you will be taken to the e-verification page. On successful validation, your request will be submitted.

A success message will be displayed. You will also receive a confirmation message on your e-mail ID and mobile number registered with the e-Filing portal.

Watch Video on Section 154

Case Laws on Section 154

Publication:

Citation:

Appellant:

Respondent:

Court:

Authority:

High Court:

Tribunal:

Justice:

Appeal No:

Date:

Section:

Asstt Year:

Favouring:

About Taxpundit Team

Our team consists of highly qualified, experienced and knowledgeable industry professionals that are passionate and dedicated to our clients. We provide the best possible service to our clients in a timely and effective manner, whilst always adhering to the highest levels of quality.