Introduction

EVerify ITR – To complete the ITR submission, e-verifying the ITR is a mandatory part of the process. However, if you fail to e-verify within the stipulated time, the ITR becomes invalid and will be termed a “defective return”. There are several convenient options as listed below to e-verify your ITR and one of them is E-Verification with Digital Signature Certificate (DSC). In this article we will discuss how to verify ITR using DSC.

What are the different ways in which ITR can be Verified?

You can EVerify ITR your returns online using:

- OTP on mobile number registered with Aadhaar, or

- EVC generated through your pre-validated bank account, or

- EVC generated through your pre-validated demat account, or

- EVC through ATM (offline method), or

- Net Banking, or

- Digital Signature Certificate (DSC).

What is DSC?

Digital Signature Certificate (DSC) is the electronic format of a physical or paper certificate. DSC serves as proof of identity of an individual or Organization for a certain purpose online / on computer. DSC authenticates and electronic document like how a handwritten signature authenticates a printed / handwritten document. DSC can be used to e-Verify returns filed by a taxpayer and is also mandatory in some cases.

A valid DSC can be procured from a certifying authority and the same must be registered on the e-Filing portal post login.

Benifits of Digital Signature

It is also considered a secure way to file the Income-Tax Return (ITR). In addition, some of the prominent benefits are prescribed below:

Digital Signature offers more security than any other conventional or electronic signature.

India’s and even the majority of the world’s governments recognize digital signatures.

The risks of attacks from hackers or phishing emails to steal sensitive data are minimum.

Your documents remain secure and cannot be edited or altered in any way after signing.

The greatest advantage of using DSCs, at the time of e-filing ITR is the privacy of the confidential data when shared online.

Is E-Verification with DSC mandatory?

DSC is mandatory for some services / user categories such as e-Verification of returns filed by companies and political parties as well as other persons whose accounts are required to be audited under Section 44AB of the Income Tax Act. In other cases, it is optional.

EVerify ITR with DSC

To EVerify ITR with DSC (Digital Signature Certificate) you must have :-

1. Valid and active DSC

2. Emsigner utility installed and running on your PC

3. DSC USB token procured from a Certifying Authority provider

4. Plugged-in DSC USB token in your PC AND

5. The DSC USB token is a Class 2 or Class 3 certificate.

Please note that You will not be able to e-Verify your ITR using Digital Signature Certificate if you select the e-Verify Later option while submitting Income Tax Return.

You can use DSC as an e-Verification option if you choose to e-Verify your ITR immediately after filing.

How to Save Capital Gains Tax?

Step by Step Guide

Let us understand this EVerify ITR mode step by step :-

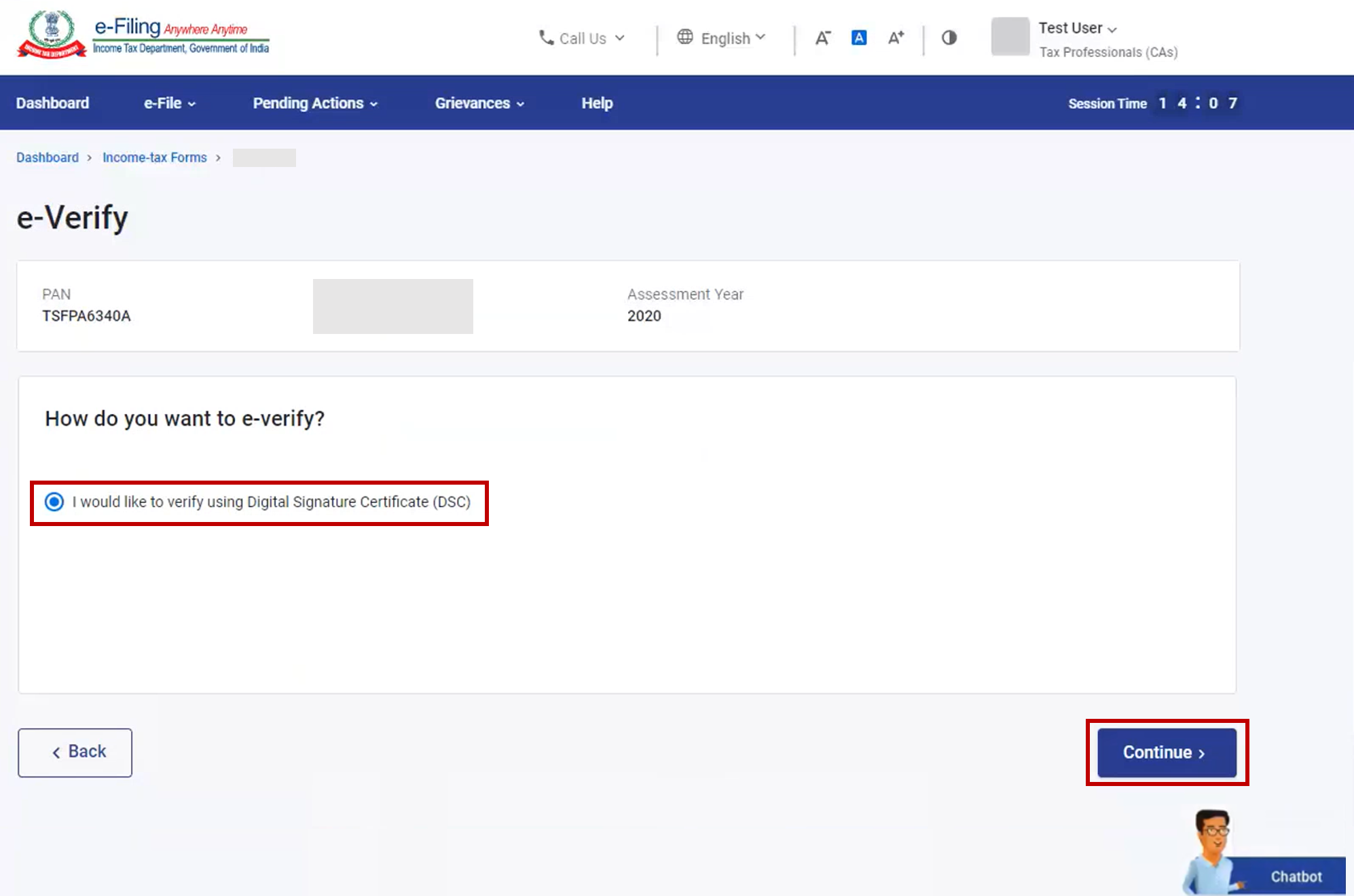

Step 1: On the e-Verify page, select I would like to e-Verify using Digital Signature Certificate (DSC).

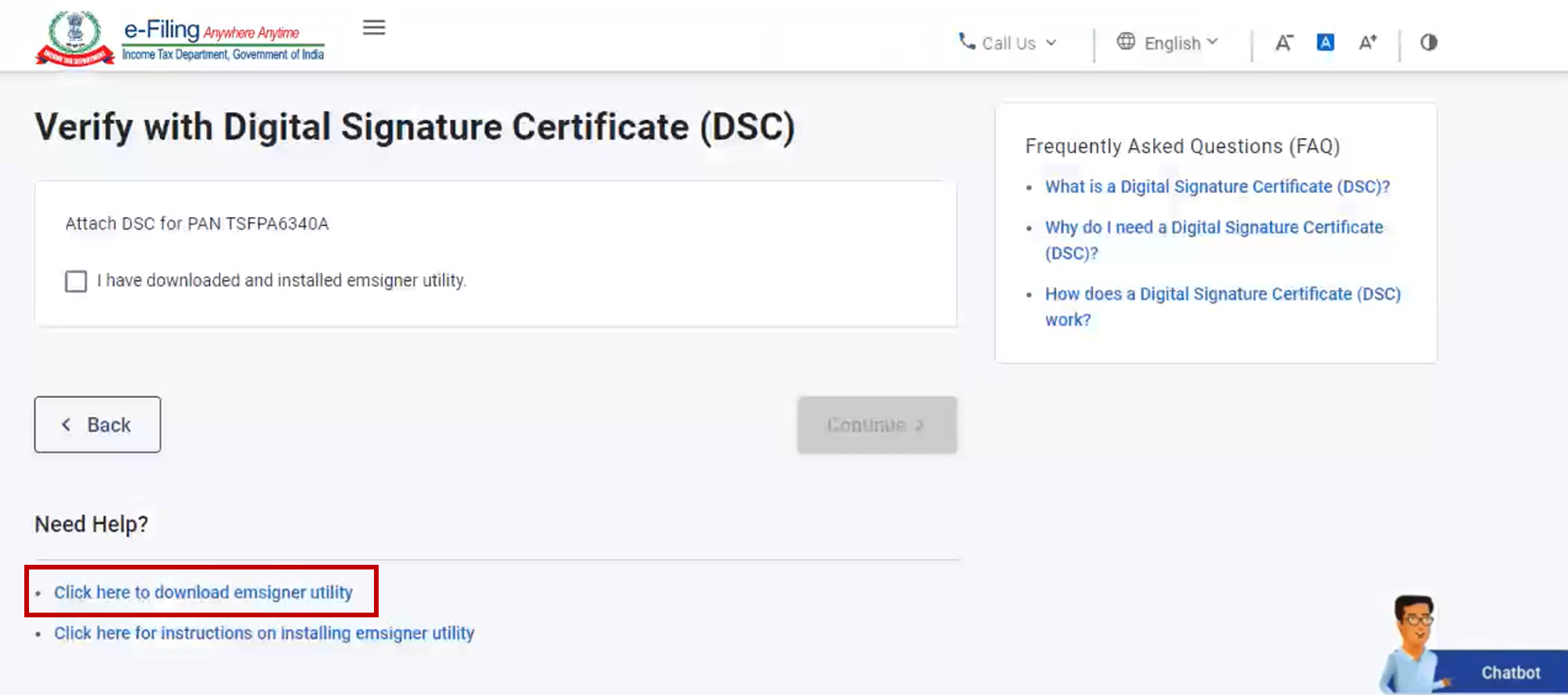

Step 2: On the Verify Your Identity page, select Click here to download emsigner utility.

Step 3: After the download and installation of emsigner utility is complete, select I have downloaded and installed emsigner utility on the Verify Your Identity page and click Continue.

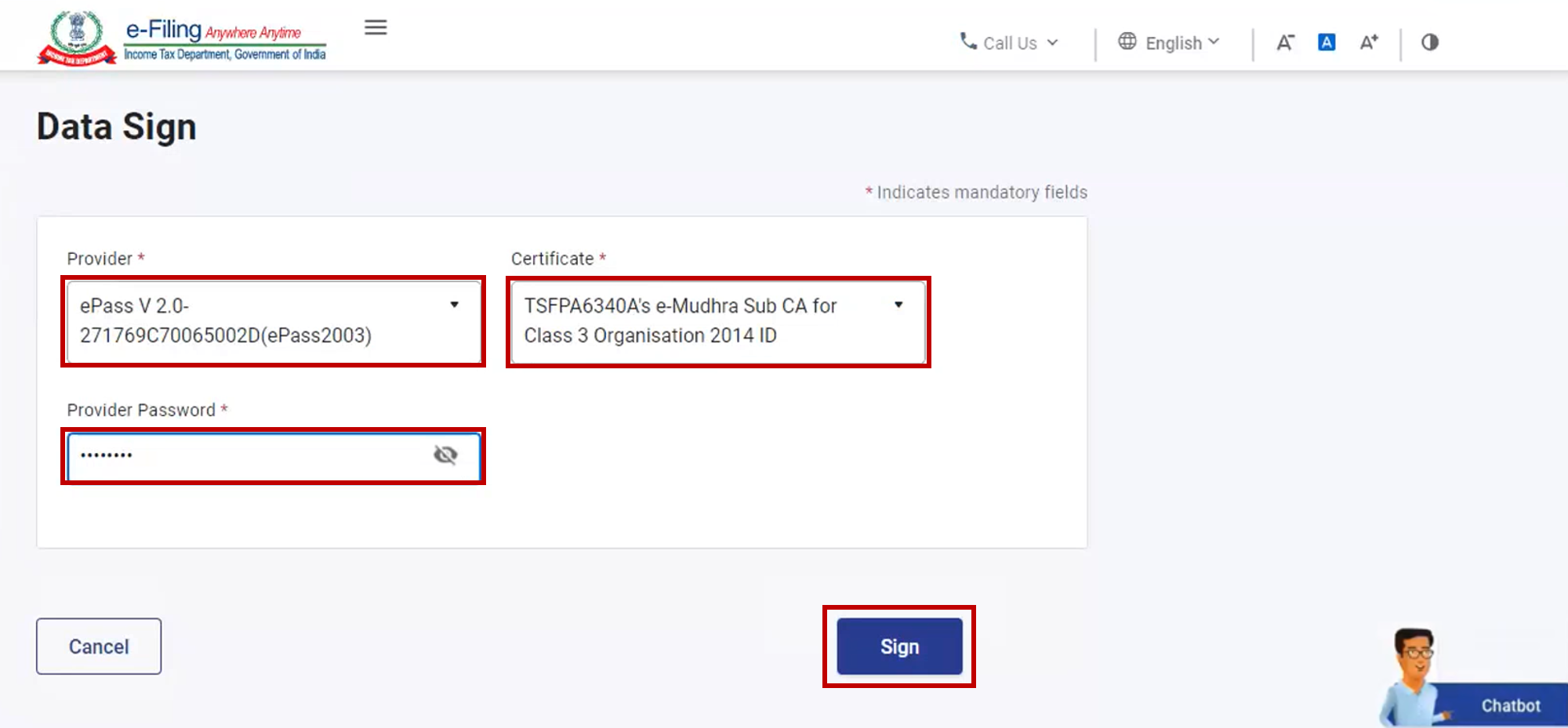

Step 4: On the Data Sign page, select your Provider, Certificate and enter the Provider Password.

Click Sign. A success message page is displayed along with a Transaction ID.

Please keep a note of the Transaction ID for future reference. You will also receive a confirmation message on your email ID and mobile number registered on the e-Filing portal.

Watch Video on How to E-Verify ITR using Digital Signature (DSC)

About Taxpundit Team

Our team consists of highly qualified, experienced and knowledgeable industry professionals that are passionate and dedicated to our clients. We provide the best possible service to our clients in a timely and effective manner, whilst always adhering to the highest levels of quality.