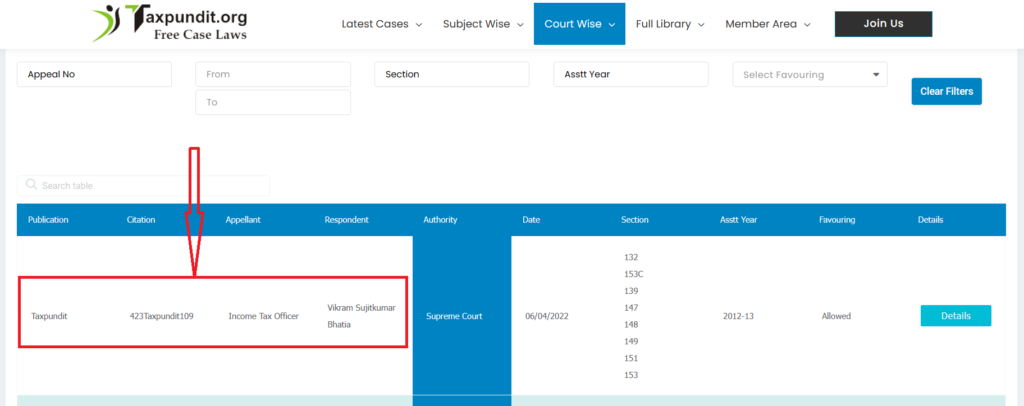

Search and Seizure : The Supreme Court on 06th April 2023 delivered a landmark verdict in case of Income Tax Officer vs Vikram Sujitkumar Bhatia and 114 connected cases ( in C.A. No. 911/2022 ) as it ruled that searches conducted before June 1, 2015 would also come under the amendment brought by the Finance Act 2015 in Section 153C of the Income Tax Act, 1961. The Supreme Court held that the amendment brought to Section 153C of the Income Tax Act 1961 by the Finance Act 2015 will retrospectively apply to searches conducted prior to the date of the amendment, i.e., 01.06.2015.

The Bench of Justice M.R. Shah and Justice C.T. Ravikumar passed the orders on a bunch of 115 applications filed by the Revenue department against the Delhi High Court order of 2014 in the PepsiCo India Ltd vs Assistant Commissioner of

Income Tax case.

What is Section 153C (Search and Seizure)?

Section 153C allows the revenue department to proceed against a party other than the person who is being searched, if incriminating articles against the “other person” is found during the search. Section 153C initially used the word “belong/belongs to”. So, if any books of accounts or documents which “belong/belongs to” a person other than the person who is being searched is discovered during the search proceedings, Section 153C enabled the department to proceed against the “other person” if the materials indicated undisclosed income or assets.

Finding of Delhi High Court in Pepsico India Ltd

However, in 2014, the Delhi High Court gave a restrictive meaning to the words “belong/belongs” in Section 153C in the case PepsiCo India Ltd. v/s Assistant Commissioner Of Income Tax. The High Court held that the word used in the Section cannot be confused as “relates to” or “refers to”. The HC held that if photocopies of a document are seized from a person, it cannot be said that the document “belongs” to that person, as the originals are with someone else. The High Court further held that if a registered sale deed is found during the search premises, it cannot “belong” to the vendor though the vendor’s name is mentioned there.

Amendment in Section 153C

To nullify the decision of the Delhi High Court, Section I53C was amended by Finance Act 2015 to substitute the words “belong/belongs to” with “pertain/pertains to and relates to”. The issue in the aforementioned batch of appeals before the Supreme Court was whether this amendment will apply to searches undertaken before the 2015 amendment.

This issue was answered in favour of revenue wherein a bench comprising of Hon’ble Justices MR Shah and CT Ravikumar placed heavy reliance on the objects and reasons of the 2015 amendment. The bench noted that the 2015 amendment was specifically brought to remove the basis for the Delhi High Court’s judgment. The amendment was necessitated because of the “narrow and restrictive” meaning given by the Delhi High Court which limited the powers of the revenue to proceed against third parties even if incriminating materials were found against them during the search.

“The said observation of the Delhi High Court was coming in the way of suppressing the very mischief which the legislature intended to suppress, which necessitated the amendment to Section 153C”, the Court observed.

Read our Article on LTCG on Sale of Shares

Finding of Supreme Court

Therefore, the Apex Court held that it was necessary to give effect to the manifest intention of the legislature while interpreting the provision. Once the primary intention is ascertained and the object and purpose of the legislature is known, it becomes the duty of the court to give a purposive and functional interpretation. The contention of the revenue that Section 153C is a machinery provision and hence its manifest purpose should be given effect to was accepted by the Court.

Also, the 2015 amendment was a case of substitution of words, whereby “belong/belongs” was replaced with “pertain/pertains”. Referring to precedents, the bench noted that amendment by substitution has the effect of wiping the earlier provision off the statute book as if the the unamended provision never existed.

The bench also rejected the argument of assesees that the retrospective application of the amendment will affect the substantive rights of the individuals. “Though the submission is attractive, it deserves to be rejected”, the bench said by pointing out that even the un-amended Section 153C pertains to the assessment of income of any other person. The object and purpose of Section 153C is to address the persons other than search persons and even as per the unamended Section, the bench said.

Allowing the batch of 115 appeals filed by the revenue against the High Court’s judgments which refused to allow the retrospective application of the amendment, the Supreme Court held : “The question wether the amendment brought to Section 153C of Income Tax Act by Finance Act 2015 would be applicable to searches conducted under Section 132 of the Income Tax Act act before 01.06.2015, i.e the date of the amendment is answered in favour of revenue and against the assesees.

It is held that amendment brought to Section 153C by Finance Act 2015 shall also be applicable to searches conducted under Section 132 of the Act before 01.06.2015, i.e the date of amendment”.

Download Link of ITO Vs. Vikram Sujitkumar Bhatia

Frequently Asked Questions

Section 153C allows the revenue department to proceed against a party other than the person who is being searched, if incriminating articles against the “other person” is found during the search. Section 153C initially used the word “belong/belongs to”.

Supreme Court held that amendment brought to Section 153C by Finance Act 2015 shall also be applicable to searches conducted under Section 132 of the Act before 01.06.2015, i.e the date of amendment”.

The HC held that if photocopies of a document are seized from a person, it cannot be said that the document “belongs” to that person, as the originals are with someone else.

Watch our Video Tutorial on Section 80G

CA Mohit Gupta

B.Com(H), FCA, DISA

Mr. Mohit Gupta is a Fellow Member of the ICAI. He is practicing as a Chartered Accountant for more than 15 years in the core domain of direct taxation. He can be reached at ca.mohitgupta@icai.org