taxpundit@taxpundit.org

Try our GST Case Laws : Supreme Court, High Courts, AR, AAR. Buy Any Combo Plan. Click on Join Us!

Authenticate Notice : Every communication by Income Tax department issued on or after 1st October, 2019 shall bear an unique Document Identification Number(DIN).

In order to satisfy yourself that the notice/order or any communication received by you is genuine and issued by Income Tax Authority, you can authenticate any notice/order or any communication using this service.

Authenticate Notice / Order issued by ITD service is available to both registered and unregistered users of the e-Filing portal as a pre-login service to verify the authenticity of a Notice, Order, Summons, Letter or any correspondence issued by Income Tax Authorities.

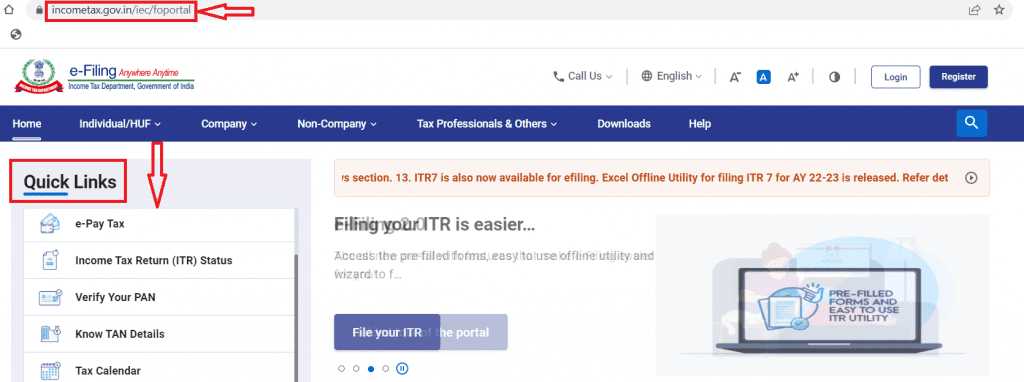

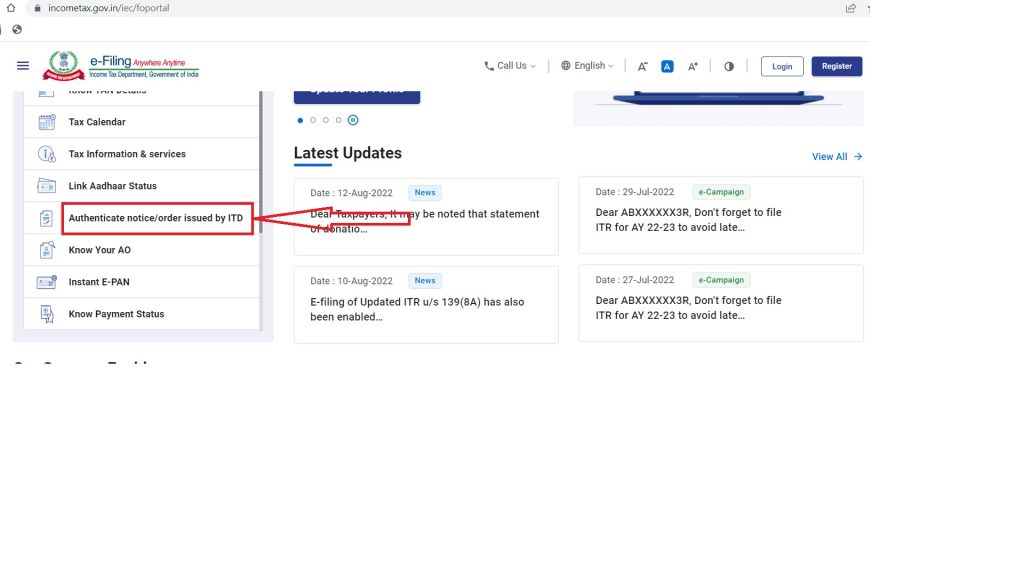

Step 1: Go to the Income Tax Portal homepage.

Step 2: Click Authenticate Notice / Order issued by ITD under Quick Links.

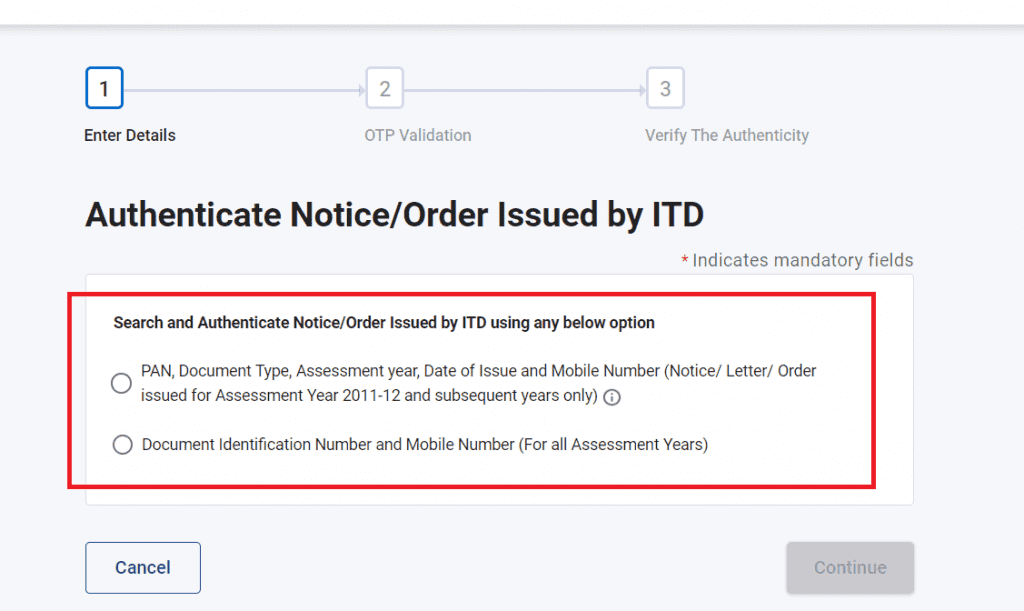

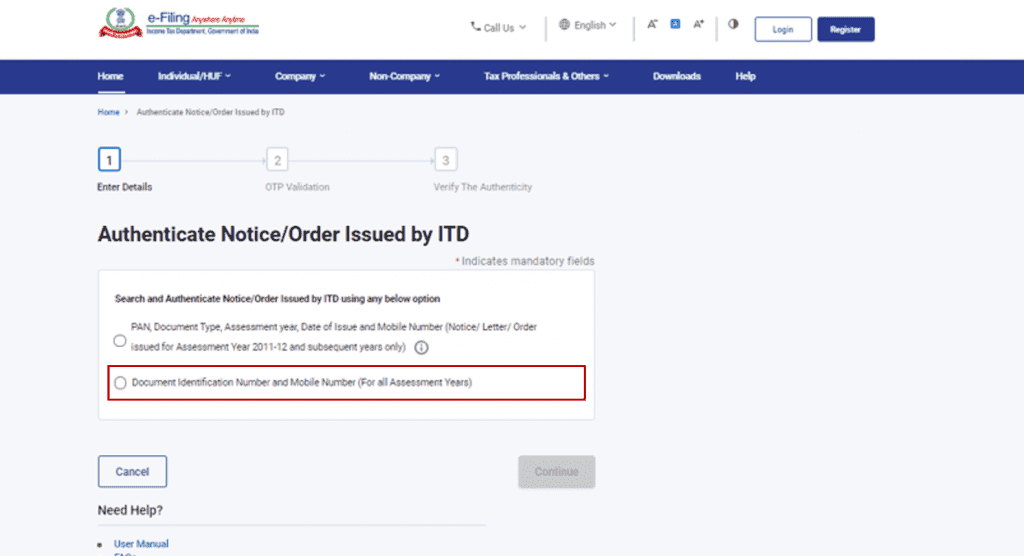

Step 3: Select either of the following options to authenticate the notice / order –

How to Calculate Interest under Section 234C?

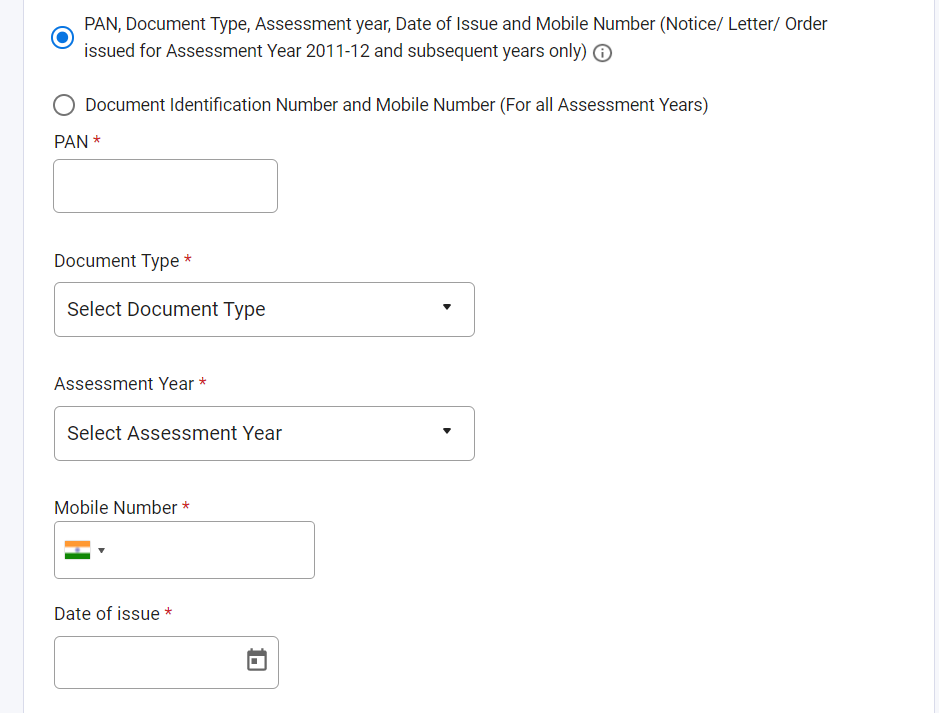

Step A: Enter PAN, Document type, Assessment Year, Date of Issue and Mobile Number and Click Continue.

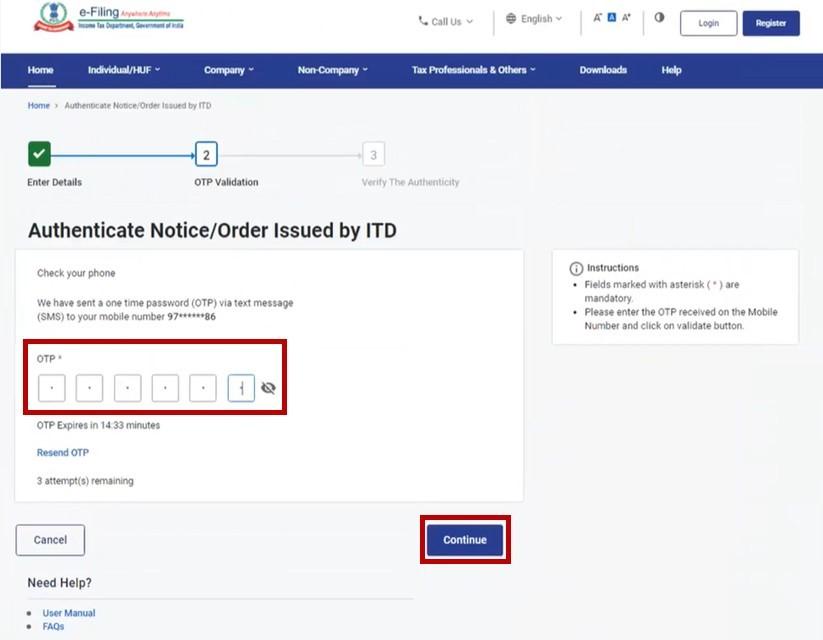

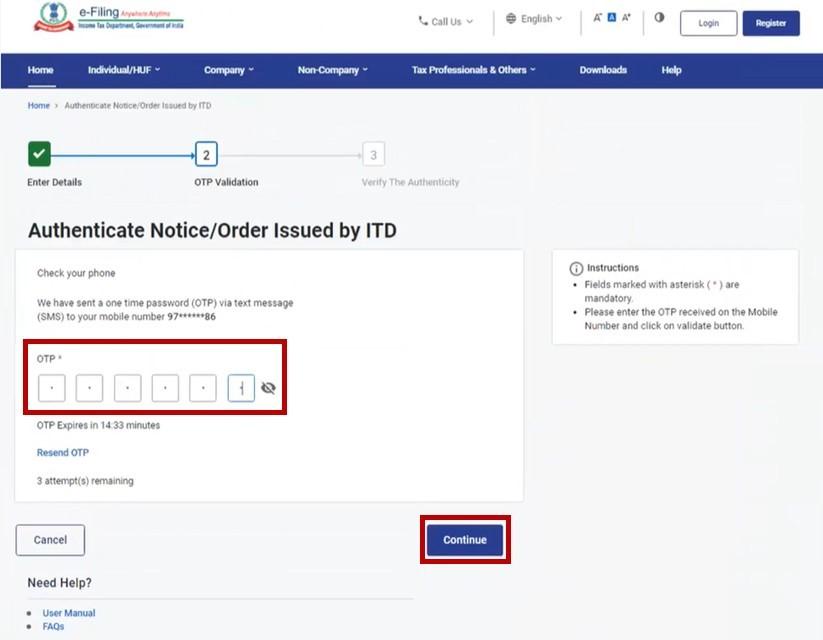

Step B: Enter the 6-digit OTP received on the mobile number entered by you in Step 2 and click Continue.

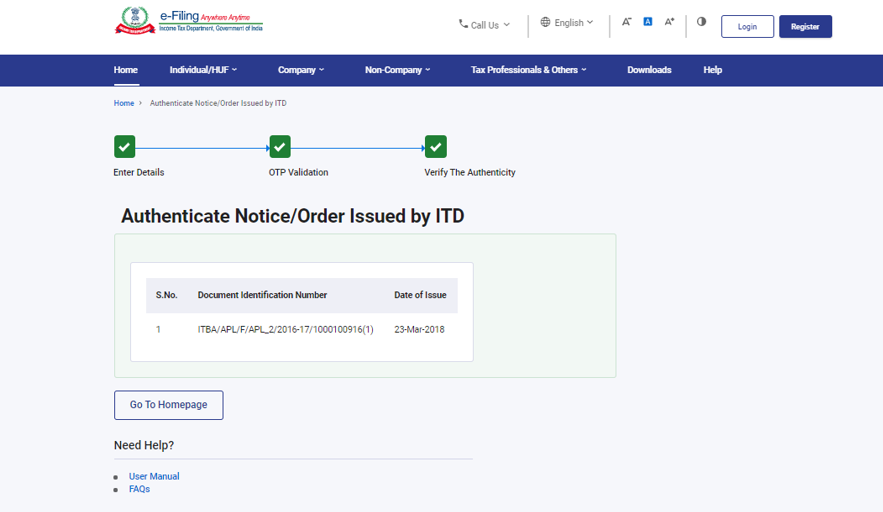

Once the OTP is validated, the document number of the notice issued along with the date of issue of the notice will be displayed.

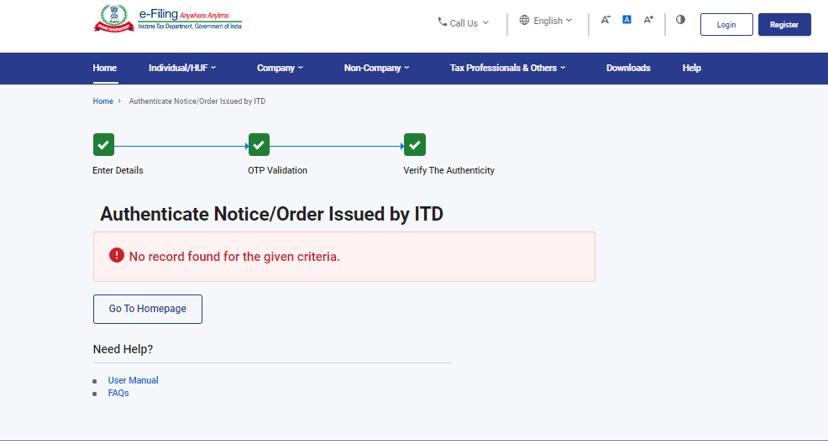

Note: In case no notice was issued by ITD, it will display a message – No record found for the given criteria.

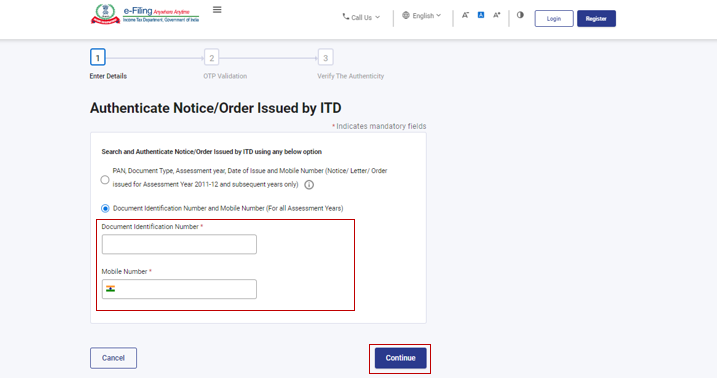

Step A: Select Document Identification Number and Mobile Number.

Step B: Enter Document Identification Number and Mobile Number and click Continue.

Step C: Enter the 6-digit OTP received on the mobile number entered by you in Step B and click Continue.

Note :-

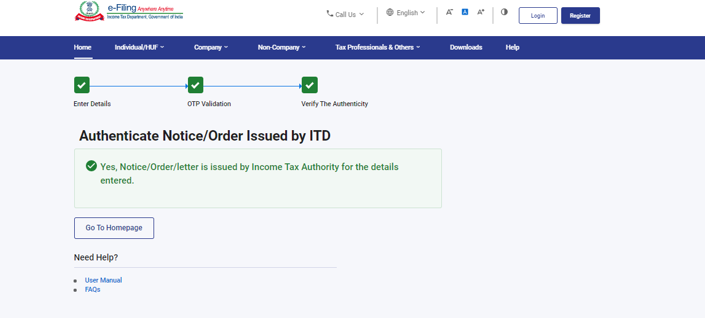

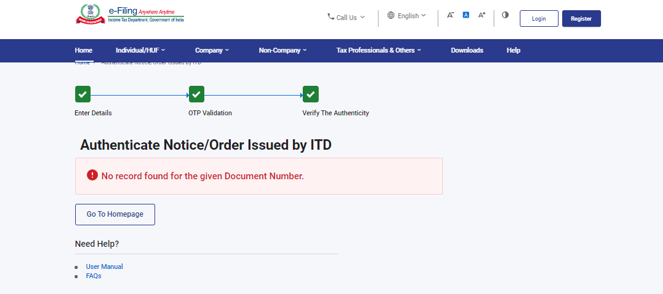

Once the OTP is validated, a success message will be displayed.

Note: In case no notice was issued by ITD, it will display a message – No record found for the given Document Number.

Our team consists of highly qualified, experienced and knowledgeable industry professionals that are passionate and dedicated to our clients. We provide the best possible service to our clients in a timely and effective manner, whilst always adhering to the highest levels of quality.